FHA mortgage insurance is a crucial aspect of the Federal Housing Administration (FHA) loan program, designed to protect lenders in case of borrower default. These insurance premiums enable many first-time homebuyers to qualify for loans, even if they have lower credit scores or insufficient down payments. Understanding the nuances of FHA mortgage insurance can significantly impact your home-buying journey and financial future.

As the housing market evolves, more prospective buyers are turning to FHA loans due to their accessibility and favorable terms. However, the associated mortgage insurance can be a source of confusion for many. This article aims to demystify FHA mortgage insurance by breaking down its components, costs, and benefits, and answering some of the most common questions surrounding it. By the end, you'll have a comprehensive understanding of how FHA mortgage insurance works and its implications for homeowners.

Whether you're a first-time homebuyer or looking to refinance an existing mortgage, knowing about FHA mortgage insurance is essential. With the right information, you can make informed decisions that will benefit you in the long run. Let’s dive into the details of FHA mortgage insurance and explore what you need to know.

What is FHA Mortgage Insurance?

FHA mortgage insurance is a type of insurance that borrowers must pay when taking out a mortgage through the FHA. This insurance protects lenders against losses if a borrower defaults on their loan. The FHA provides these loans to encourage homeownership, especially among those who might not qualify for conventional financing due to lower credit scores or smaller down payments.

Why Do You Need FHA Mortgage Insurance?

FHA mortgage insurance is essential for several reasons:

- It allows buyers with lower credit scores or smaller down payments to access home financing.

- It protects lenders from financial losses, thus encouraging them to offer more loans.

- It contributes to the overall stability of the housing market.

How Much Does FHA Mortgage Insurance Cost?

The cost of FHA mortgage insurance can vary based on several factors, including the size of the loan and the down payment. Typically, there are two types of premiums associated with FHA mortgage insurance:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time fee that is calculated as a percentage of the loan amount. As of now, the UFMIP is 1.75%.

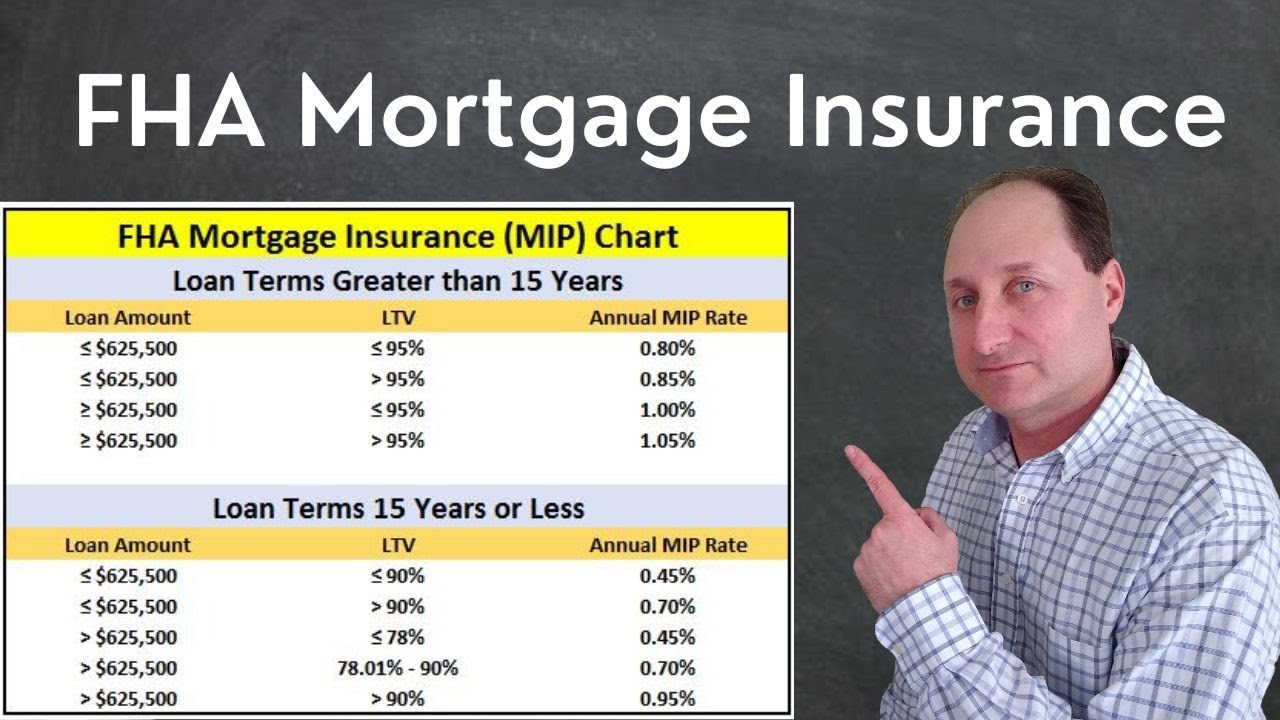

- Annual Mortgage Insurance Premium (MIP): This is charged monthly and varies based on the loan term and loan-to-value (LTV) ratio. It can range from 0.45% to 1.05%.

How Long Do You Have to Pay FHA Mortgage Insurance?

One of the most common questions regarding FHA mortgage insurance is how long it must be paid. The duration depends on your initial down payment:

- If your down payment is less than 10%, you'll pay MIP for the life of the loan.

- If your down payment is 10% or more, you'll pay MIP for 11 years.

Can You Remove FHA Mortgage Insurance?

Yes, there are circumstances under which you can remove FHA mortgage insurance. If you've built sufficient equity in your home or refinanced into a conventional loan, you may be able to eliminate the FHA mortgage insurance requirement. Additionally, if you initially put down 10% or more, you can request the cancellation after 11 years of timely payments.

Is FHA Mortgage Insurance Worth It?

When considering whether FHA mortgage insurance is worth the cost, you need to weigh the benefits against the premiums:

- Pros: Easier qualification, lower down payments, and access to competitive interest rates.

- Cons: Long-term costs and the inability to eliminate insurance if your down payment is less than 10%.

How Does FHA Mortgage Insurance Compare to Private Mortgage Insurance (PMI)?

FHA mortgage insurance is often compared to private mortgage insurance (PMI), which is required for conventional loans with less than 20% down payment. Here’s a quick comparison:

| Feature | FHA Mortgage Insurance | PMI |

|---|---|---|

| Requirements | Mandatory for FHA loans | Required for conventional loans with < 20% down |

| Cost | 1.75% UFMIP + monthly MIP | Varies based on credit score and lender |

| Duration | Life of the loan or 11 years | Can be removed when equity is built |

What Are the Alternatives to FHA Mortgage Insurance?

If FHA mortgage insurance seems too costly or not suitable for your financial situation, consider these alternatives:

- Conventional Loans: If you have a good credit score and can make a larger down payment, this option may be more affordable.

- VA Loans: For eligible veterans, these loans do not require mortgage insurance.

- USDA Loans: Suitable for rural homebuyers, these loans also have lower insurance costs.

Conclusion: Is FHA Mortgage Insurance Right for You?

FHA mortgage insurance plays a significant role in making homeownership accessible for many Americans. While it comes with costs that can seem daunting, the benefits of securing a home loan with favorable terms often outweigh the disadvantages. By understanding how FHA mortgage insurance works, you can make informed decisions about your home-buying journey.

Ultimately, whether FHA mortgage insurance is right for you depends on your unique financial situation, long-term goals, and homeownership aspirations. It’s essential to weigh your options and consult with a financial advisor or mortgage professional to determine the best path forward.

Article Recommendations

- Intriguing 2019 Billboard In Owensboro Ky Featuring Mitch Mcconnell

- Megan Fox Movies Online Free Streaming Hd

- Empowering Community Recovery The Impact Of Go Fund Me Malibu Fire Campaigns